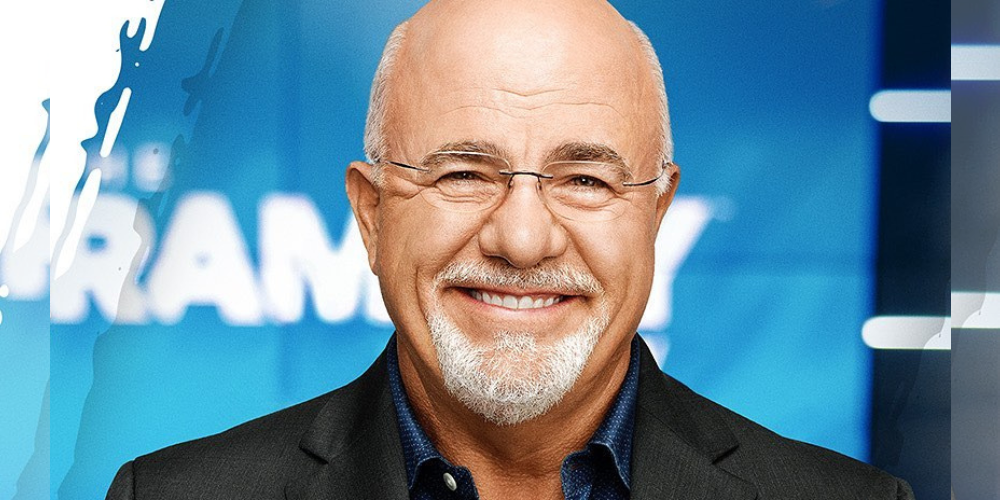

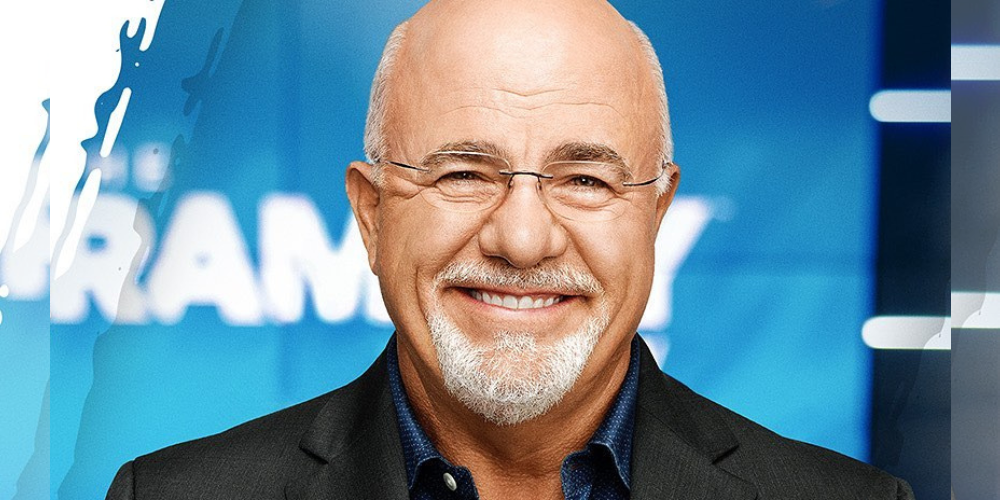

Take Action Now: Dave Ramsey’s Expert Money Advice Revealed

Running a small business is more than just a daily grind – it’s a passionate pursuit fueled by dreams, determination, and, yes, a healthy dose of hustle. But along the way, even the most enthusiastic entrepreneurs can encounter unexpected roadblocks, one of the most common being late payments from clients. Especially when those clients happen to be close friends.

The delicate dance between business and personal relationships takes on a whole new dimension when you’re staring down an unpaid invoice from someone you hold dear.

Freepik | our-team | Owning a small business is not just a daily grind; it’s a passionate pursuit driven by dreams.

On one hand, you cherish the camaraderie and shared history, wanting to avoid damaging trust. On the other, your livelihood and the success of your venture depend on financial stability. This internal tug-of-war can leave you feeling conflicted, confused, and unsure of how to proceed.

Facing the Payment Gap

Let’s delve into a scenario familiar to many small business owners. Imagine pouring your heart and soul into your craft, delivering stellar service to a valued client, only to face the disappointment of a delayed payment. Time ticks by, the invoice sits unopened, and the promised funds remain elusive. You grapple with a cocktail of emotions – concern for their situation, frustration at the inconvenience, and perhaps even a tinge of resentment.

Communication is Key

Freepik | Open communication is key to preventing silence from becoming problematic.

Instead of letting the silence fester, open communication is crucial. Schedule a casual meet-up or hop on a friendly call to understand their situation. Actively listen to their explanation without jumping to conclusions or making accusations.

Remember, your friend might be facing unforeseen challenges, temporary cash flow hiccups, or simply have an oversight. Approaching the situation with empathy and understanding can pave the way for a productive resolution.

Finding Common Ground

Once you’ve established the reason behind the delay, work together to find a win-win solution. Propose a flexible payment plan with clear installments and deadlines. Discuss options like upfront deposits or progress payments on larger projects.

Remember, flexibility goes both ways – be open to adjusting your terms slightly to accommodate their needs while still ensuring you receive your due compensation.

Setting Boundaries with Grace

Freepik | Prompt payments are crucial for maintaining healthy business relationships.

While amicability is vital, don’t be afraid to establish firm boundaries. Clearly communicate your payment expectations and express the impact their delay has on your business. Remind them that prompt payments are not just a courtesy, but an essential element of any business relationship.

Be prepared to walk away if your terms are consistently disregarded – your financial well-being and professional integrity take precedence.

Learning from the Experience

Ultimately, this experience, though potentially stressful, can serve as a valuable learning opportunity. It underscores the importance of clear communication and establishing financial agreements upfront with every client, regardless of personal ties. Moving forward, consider implementing written contracts that outline payment terms and consequences for late payments.

Remember, running a small business is a journey filled with triumphs and challenges. Navigating the complexities of client relationships, especially when finances are involved, is just another obstacle to overcome. With a blend of empathy, assertiveness, and clear communication, you can navigate these delicate situations and emerge stronger, wiser, and ready to continue building your entrepreneurial dream.

More in business management

-

`

Amazon’s $4 Billion Investment in Anthropic

In a move highlighting the intensifying battle in the tech industry, Amazon recently announced its substantial investment of up to $4...

November 24, 2023 -

`

Is the Future of Shopping Cashless?

The way we shop has significantly transformed in recent years, thanks to the rise of cashless payments. Traditional methods of exchanging...

November 18, 2023 -

`

Jeff Bezos and Lauren Sánchez’s $500 Million Superyacht

Set your course for a journey into the world of maritime magnificence as we unveil the $500 million superyacht belonging to...

November 11, 2023 -

`

Unlocking True Sustainability in Business and Finance

In the race towards a greener future, businesses and financial institutions have been progressing at a snail’s pace despite their public...

November 5, 2023 -

`

The Business of FaZe Clan

In the ever-evolving landscape of professional gaming and esports, few names have left as indelible a mark as FaZe Clan. Established...

October 26, 2023 -

`

7 Benefits of Shopping Sustainably

In a world that’s becoming increasingly aware of the environmental crisis, sustainable shopping has emerged as a powerful tool for individuals...

October 17, 2023 -

`

How the U.K. Became the Supercar Capital of the World

Picture the narrow streets of Milan with the roar of a Lamborghini passing by or the Autobahn with a Porsche zipping...

October 13, 2023 -

`

Fidelity’s Guide to Retirement: How to Join the Millionaire Club

Picture this: You are lounging on a yacht, the sun’s warm rays are making the turquoise waters shimmer. And the best...

October 6, 2023 -

`

Unlocking Opportunities in the Age of Automation

The world is on the brink of a robotic revolution, and it’s not just about the machines taking over. Companies pioneering...

September 28, 2023

You must be logged in to post a comment Login