Critical Money Advice From One of The World’s Most Successful Men

If you want a medical-related opinion, you go to a doctor, right? And not just any doctor, you try to find the best doctor in town. With the same logic, when you need financial advice, don’t you think the wealthiest are the right ones to ask?

Now, considering the current times, everyone could do with a little financial help. And that’s why today, we aren’t offering you the advice of a random wealthy man; instead, we’re sharing with you advice from a billionaire who is among the world’s ten richest people.

We’re talking about none other than Warren Buffett, and if you don’t know who he is, well, let’s just say today is your lucky day.

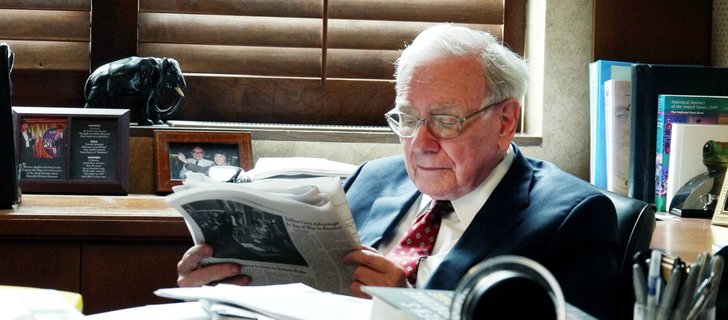

Omaha World Herald | Psst…Warren Buffett has something he’d like to share with you

Read – Top billionaires: who are the world’s richest people?

Say hello to Warren Buffett

The CEO of Berkshire Hathaway, Buffett, was previously a gum and cola seller on the street! He bought his first stock at the age of 11.

Really? Did he become an investor at 11 years of age? Isn’t that age for just being carefree and playing all the time? Not for this brilliant mind, apparently.

Warren then began teaching himself the fundamentals of trading, basic financial rules, and the best ways to trade on the stock exchange. Step-by-step, he began to climb to the top, gathering advice from here and there, reading books while working, and focusing on a simple dream.

CNBC | Buffett started investing at the age of 11! If there’s someone with good money advice, it’s him

The result? Today, the man is worth $79 billion and is counted as the seventh richest person in the world. His wealth is greater than the budgets of many countries!

Read – How Warren Buffett spends his billions

As Warren succeeded with learning and diligence, he doesn’t see more important advice than that. Here’s what he said in an interview with Yahoo Finance’s Andy Serwer.

Buffett’s golden money advice

According to Buffett, learning accounting and business rules is the only way to be successful financially. He believes that relying only on technical analysis and observing the chart’s movement is a waste of time. The key lies in fundamental analysis and the belief that by buying shares in a particular company, you put your trust in it; you become a part of it.

Warren has already given an example of this by buying shares in Coca-Cola and keeping those shares for nearly three decades. His decision stemmed from his belief in the company and his confidence in choosing it as a suitable place to put his money in. So he advises investors to do the same and revert to the classic technique of “exchange trading.”

Use Journal | The billionaire says that the only way to succeed in investing is to keep learning and conducting fundamental analysis

Wrapping It Up

Like Warren Buffett points out, reading and learning is the real key to success in any field, but it especially applies to business. The stock exchange is not a random market, and it isn’t gambling. Read carefully before you start investing, and don’t be arrogant towards good advice.

More in financial advisor

-

`

Amazon’s $4 Billion Investment in Anthropic

In a move highlighting the intensifying battle in the tech industry, Amazon recently announced its substantial investment of up to $4...

November 24, 2023 -

`

Is the Future of Shopping Cashless?

The way we shop has significantly transformed in recent years, thanks to the rise of cashless payments. Traditional methods of exchanging...

November 18, 2023 -

`

Jeff Bezos and Lauren Sánchez’s $500 Million Superyacht

Set your course for a journey into the world of maritime magnificence as we unveil the $500 million superyacht belonging to...

November 11, 2023 -

`

Unlocking True Sustainability in Business and Finance

In the race towards a greener future, businesses and financial institutions have been progressing at a snail’s pace despite their public...

November 5, 2023 -

`

The Business of FaZe Clan

In the ever-evolving landscape of professional gaming and esports, few names have left as indelible a mark as FaZe Clan. Established...

October 26, 2023 -

`

7 Benefits of Shopping Sustainably

In a world that’s becoming increasingly aware of the environmental crisis, sustainable shopping has emerged as a powerful tool for individuals...

October 17, 2023 -

`

How the U.K. Became the Supercar Capital of the World

Picture the narrow streets of Milan with the roar of a Lamborghini passing by or the Autobahn with a Porsche zipping...

October 13, 2023 -

`

Fidelity’s Guide to Retirement: How to Join the Millionaire Club

Picture this: You are lounging on a yacht, the sun’s warm rays are making the turquoise waters shimmer. And the best...

October 6, 2023 -

`

Unlocking Opportunities in the Age of Automation

The world is on the brink of a robotic revolution, and it’s not just about the machines taking over. Companies pioneering...

September 28, 2023

You must be logged in to post a comment Login