The United Kingdom Begins Open Banking: Will It Be For The Better Or Worse?

There is a new trend going around when it comes to the banking system in terms of financial technology, and that is what they call open banking. This idea actually started in 2015, where the European Parliament actually revised the PSD or the Payment Services Directive, which is now the PSD2. The parliament revised it so that there will be new rules that has the goals of being able to promote as well as to develop the use of online and mobile payments with the use of open banking. Now that term is something that is definitely new, which is why people still don’t seem to be familiar with it, so if you want to know more about open banking, continue reading.

What is open banking?

Last 13th of January 2018, United Kingdom has become the very first ones to embark their financial journey with open banking. Open Banking is actually when described as to when the top 9 banks in the United Kingdom namely, HSBC, Barclays, Lloyd’s, Santander, RBS, Bank of Ireland, Allied Irish Bank, Danske, and Nationwide, must share their customer’s date with other companies, but only with their customer’s consent of course. This includes their credit cards and all their bank accounts, for a better financial transparency. This could them make the companies carry out payments for their customers. Of course, ATM’s and other traditional banking are very much in place, this is just for an innovative start to embrace the fact that financial technology is evolving and it must always be to the people’s advantage.

Experts believe that this could definitely change the way people manage their money, either for good or bad.

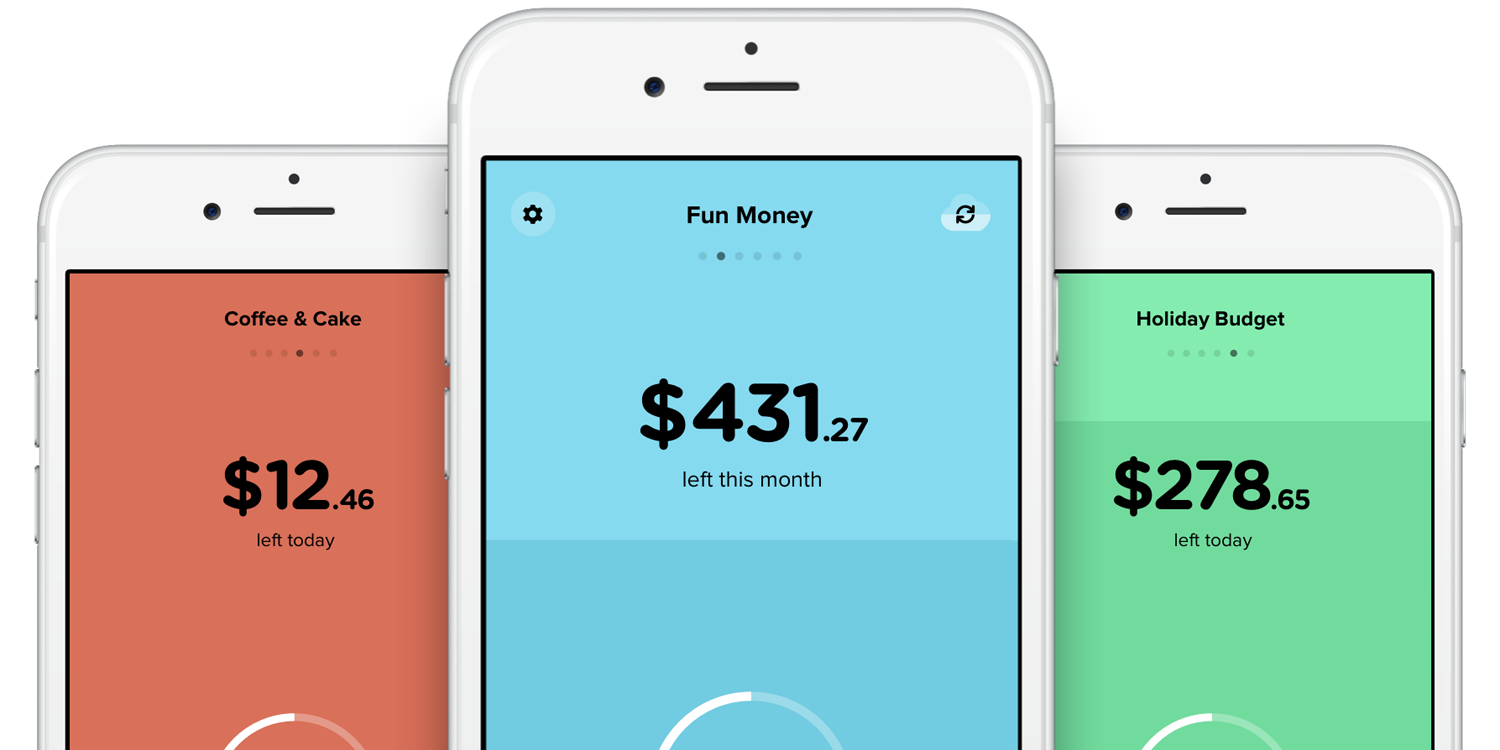

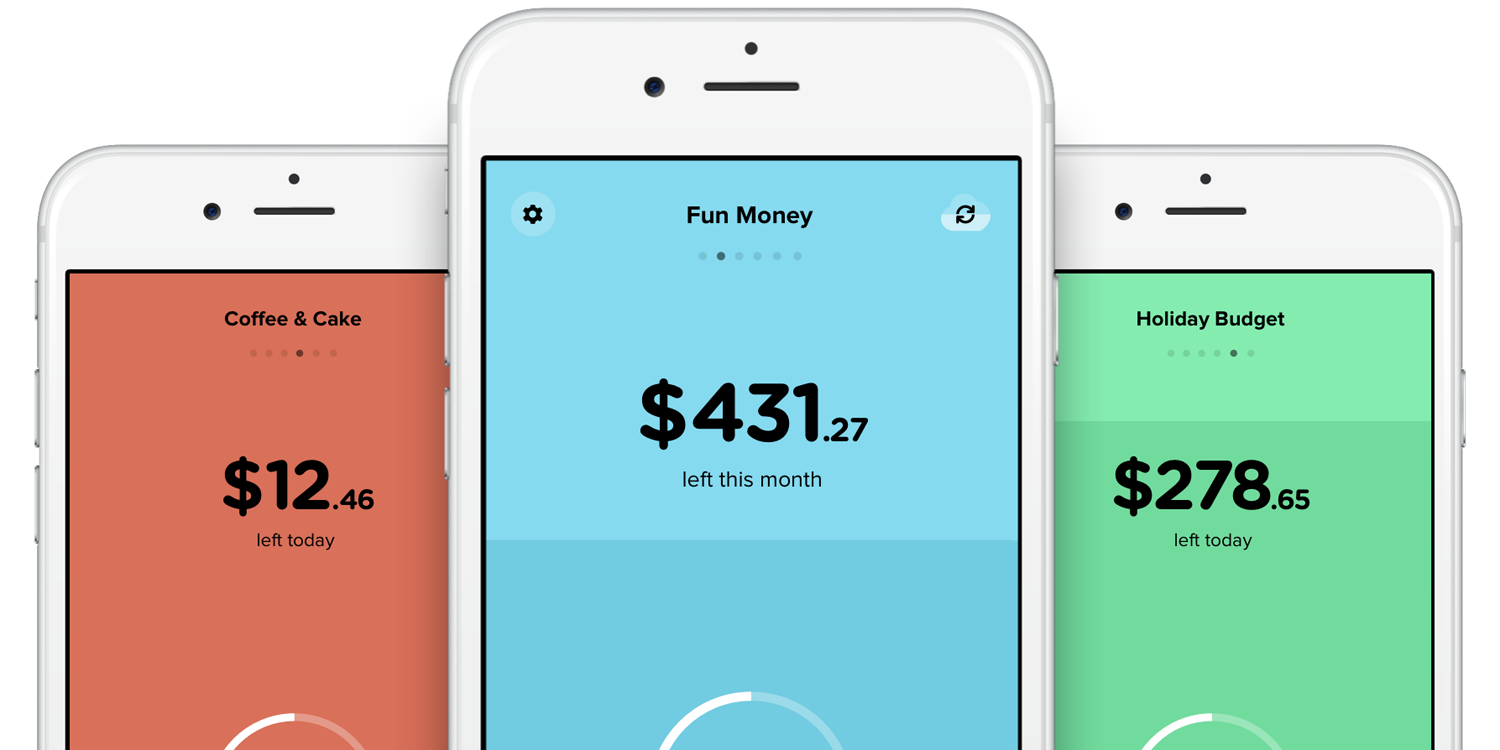

According to Ed Maslaveckas, who is the CEO of fin-tech startup Bud, who is working with United Kingdom bank HSBC for open banking said that the bank now have access to things that they didn’t get to have access before and that is having the power to be able to pull data as well as manage to do transactions on behalf of their customers, regardless of where their customers are. The bank will simply scan the account of their customers from their smartphones with a help of a certain app. The banks were of course given a newer and safer security standards and was given 18 months to do so.

What Does Open Banking Mean For Consumers?

The United Kingdom is the very first country in the world to take on and actually implement open banking. Experts believe that banks wouldn’t be able to pull this off this year, with a lot of private testing involved, but banks and customers will eventually get a hang of it within the next two to three years and it will, of course, be better.

Consumers wonder what this would mean for them and one of the things that they will start to notice immediately is the more refined and sophisticated apps from their banks that require tons of details and information compared from the usual apps. According to an interview with the CEO of a financial dashboard known as Moneyhub, who has worked with Lloyd’s Bank said that one of the things that they were able to do is to get access to an account and set up default limits as well as move money from savings to others. If a person has managed to have some spare money, they could have the option to send it to their savings in just one click. This could also mean that when people go shopping, all they need to is to scan a barcode for payment, and then the purchase is done, simple as that. However, this is not guaranteed to be done right away since banks and companies are still in their testing stages. Then again, experts believe that in a year or two, all of these could start happening.

It is very understandable for people to be skeptical since this would involve their security details. Giving access to banks to have every information and giving them the power to make a transaction on your behalf can be a bit worrying since it involves technology, and technology is not perfect nor it will ever be. People are concerned about glitches or apps crashing and things like that, which is why banks and companies are doing everything they can to prevent any sort of problems that they may face with the all new open banking.

More in lifestyle & luxury

-

`

How To Travel the World Using Credits

Traveling can be an exhilarating and enriching experience, but it can also be expensive. However, with the right strategies and planning,...

December 3, 2023 -

`

Amazon’s $4 Billion Investment in Anthropic

In a move highlighting the intensifying battle in the tech industry, Amazon recently announced its substantial investment of up to $4...

November 24, 2023 -

`

Is the Future of Shopping Cashless?

The way we shop has significantly transformed in recent years, thanks to the rise of cashless payments. Traditional methods of exchanging...

November 18, 2023 -

`

Jeff Bezos and Lauren Sánchez’s $500 Million Superyacht

Set your course for a journey into the world of maritime magnificence as we unveil the $500 million superyacht belonging to...

November 11, 2023 -

`

Unlocking True Sustainability in Business and Finance

In the race towards a greener future, businesses and financial institutions have been progressing at a snail’s pace despite their public...

November 5, 2023 -

`

The Business of FaZe Clan

In the ever-evolving landscape of professional gaming and esports, few names have left as indelible a mark as FaZe Clan. Established...

October 26, 2023 -

`

7 Benefits of Shopping Sustainably

In a world that’s becoming increasingly aware of the environmental crisis, sustainable shopping has emerged as a powerful tool for individuals...

October 17, 2023 -

`

How the U.K. Became the Supercar Capital of the World

Picture the narrow streets of Milan with the roar of a Lamborghini passing by or the Autobahn with a Porsche zipping...

October 13, 2023 -

`

Fidelity’s Guide to Retirement: How to Join the Millionaire Club

Picture this: You are lounging on a yacht, the sun’s warm rays are making the turquoise waters shimmer. And the best...

October 6, 2023

You must be logged in to post a comment Login