Are You Big on Credit Card Rewards? Here Are the Best Options on the Market for You

Who doesn’t love credit card rewards? The cash backs, miles, points, everything. There’s also the sign-up bonus which most people use for vacations. The thing is that as soon as you’ve banked your first one, you’re on the hook. You’ll always want to re-do it again.

Luckily, there are a lot of credit cards that pay more than a single point per every dollar you spend. As such, your daily spending, say, gas, travel, or dining can see you accumulate points without breaking a sweat.

Dining

You may want to especially maximize your spending on food, with this expenditure being a favorite among Americans. According to the Business Insider, Americans spent $3,424 on dining between 2017-2018.

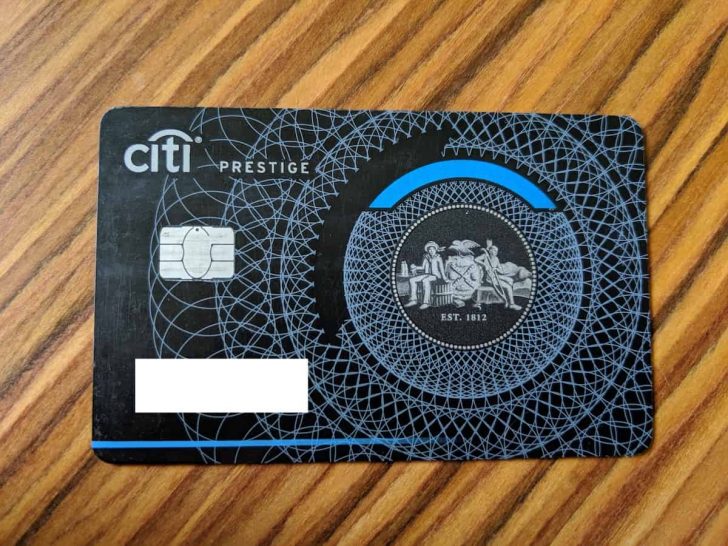

So, which cards would provide the best bonuses for this particular expense? With Citi Prestige, you can never go wrong, especially because they offer 5 points for a dollar spent. The points are worth 1.7 cents, offering an 8.5% return on your spending.

You can never go wrong with Citi Prestige

Other great credit cards when it comes to dining include American Express Gold Card, Chase Sapphire Reserve, American Express’ Hilton Honors Aspire Card, Uber Visa, Capital One Savor, and Costco Anywhere.

For gas, the American Express Business Gold Card is your best bet. With this one, you get an 8% return on whatever you spend. The Costco Anywhere card is also a viable option, along with the Citi Premier and Hilton Honors Surpass card.

Groceries are yet another thing that Americans spend big on. As such, it is only wise that your purchases earned you the valuable points. The American Express Gold Card can get you a return of as high as 8% on your spending, making it the first option in this category.

The American Express Gold Card can get you a return of as high as 8%

The Blue Cash Everyday and Blue Cash Preferred, both under American Express are also safe bets to go with, and you can never regret choosing either of them.

If you’re big on flying, then this part is for you. The American Express’ Platinum Card offers a 10% return, but you have to strictly book your hotels via amextravel.com. The Chase Sapphire Reserve card comes next, with a 6% return.

The Gold Card by American Express can’t be left behind either, offering the same return as the Sapphire. Other great cards include Citi Premier, Citi Prestige, Uber Visa, and Costco Anywhere.

The Rest

Now that we’ve touched on major American spending habits, how about all the rest? Are there cards that offer rewards on other expenses? Of course, yes. One example is the Chase Freedom Unlimited. With this one, you get a 1.5% return on everything.

With Chase Freedom Unlimited, you get a 1.5% return on everything

Discover it Cash Back and Discover it Miles offer returns of 3% and 5% respectively, so you’re at liberty to choose whichever pleases you.

Most of the cards that offer cashback on everything offer a return of at least 1.5%. However, though they may be sold under the guise of giving cashback on all purchases, there are some distinct expenses that are not eligible for points.

Thing is, there are lots of credit cards out there that give you value for money. Before applying for one, you’ve only got to shop around for the best one available.

More in shopping & credit

-

`

How To Travel the World Using Credits

Traveling can be an exhilarating and enriching experience, but it can also be expensive. However, with the right strategies and planning,...

December 3, 2023 -

`

Amazon’s $4 Billion Investment in Anthropic

In a move highlighting the intensifying battle in the tech industry, Amazon recently announced its substantial investment of up to $4...

November 24, 2023 -

`

Is the Future of Shopping Cashless?

The way we shop has significantly transformed in recent years, thanks to the rise of cashless payments. Traditional methods of exchanging...

November 18, 2023 -

`

Jeff Bezos and Lauren Sánchez’s $500 Million Superyacht

Set your course for a journey into the world of maritime magnificence as we unveil the $500 million superyacht belonging to...

November 11, 2023 -

`

Unlocking True Sustainability in Business and Finance

In the race towards a greener future, businesses and financial institutions have been progressing at a snail’s pace despite their public...

November 5, 2023 -

`

The Business of FaZe Clan

In the ever-evolving landscape of professional gaming and esports, few names have left as indelible a mark as FaZe Clan. Established...

October 26, 2023 -

`

7 Benefits of Shopping Sustainably

In a world that’s becoming increasingly aware of the environmental crisis, sustainable shopping has emerged as a powerful tool for individuals...

October 17, 2023 -

`

How the U.K. Became the Supercar Capital of the World

Picture the narrow streets of Milan with the roar of a Lamborghini passing by or the Autobahn with a Porsche zipping...

October 13, 2023 -

`

Fidelity’s Guide to Retirement: How to Join the Millionaire Club

Picture this: You are lounging on a yacht, the sun’s warm rays are making the turquoise waters shimmer. And the best...

October 6, 2023

You must be logged in to post a comment Login