Everything to Know About Apple Pay Later

As technology continues to transform how we handle our finances, Apple Pay Later is becoming an increasingly popular option for consumers looking to purchase without the traditional constraints of credit cards. If you’re interested in this service but have yet to understand how it works fully or if it’s right for you, this blog post will cover all the details.

What Is Apple Pay Later?

Apple Pay Later is a buy now, pay later service offered by Apple. It allows users to purchase and pay back the amount in installments, similar to popular services like Afterpay and Klarna. The service is integrated into the Wallet app on Apple devices and is designed to be a convenient and streamlined alternative to traditional credit cards.

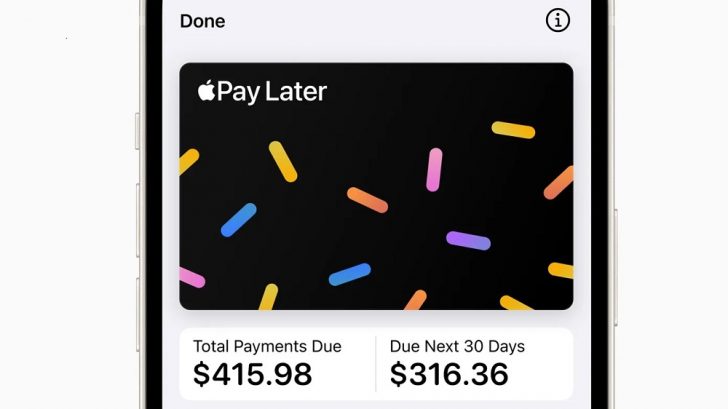

Apple/ Central Valley | The new feature lets users pay for purchases with four equal payments made every two weeks

When using Apple Pay Later, each purchase is split into four equal payments, making it easier to budget and plan for expenses. There are no interest rates or fees for using the service, and payments are automatically deducted from the user’s linked payment method.

One key difference between Apple Pay Later and credit cards is that no credit checks are required to use the service. Anyone who meets the eligibility requirements can use Apple Pay Later, regardless of their credit history.

Who Is Eligible for Apple Pay Later?

To use Apple Pay Later, users must be at least 18 and reside in the United States. They must also have a valid U.S. address and be able to link a debit or credit card to their Apple ID. There is a residual balance limit of $15,000, and users must not have any outstanding payments or overdue balances on their accounts.

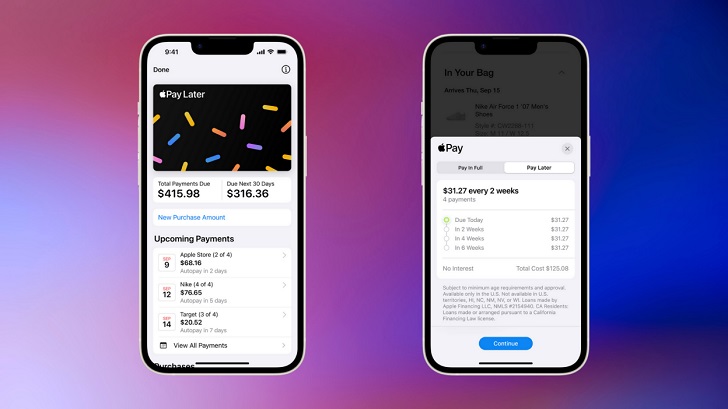

Getty Images/ Apple | Apple Pay Later pops up when you’re ready to make your purchase

How to Use

To use Apple Pay Later, go to the Wallet app on your Apple device and select the option to set up the service. From there, you can choose the desired amount for your purchase and agree to the loan terms. Once your purchase is complete, you will be prompted to make payments over the following months.

It’s worth noting that Apple Pay Later can be used in both online and brick-and-mortar stores, making it a versatile option for various needs. Repayment is automatically deducted from your linked payment method, and you can track your balances and payment schedule all in one central location.

Benefits of Apple Pay Later

One of the significant benefits of using Apple Pay Later is the lack of interest rates or fees. This means that users can make purchases without worrying about accruing additional charges over time. Additionally, the service is designed to be seamless and convenient, with easy access via the Wallet app.

Getty Images/ Tech Crunch | Users can apply for Apple Pay Later loans of $50 to $1,000

For users with multiple loans through Apple Pay Later, this central location to track and manage everything can be a significant advantage. It allows users to stay on top of their expenses and budget accordingly.

Potential Risks and How to Mitigate Them

One potential risk of using Apple Pay Later is overspending or accumulating debt. Since the service allows users to make purchases without immediate payment, it can be easy to lose track of spending. Budgeting carefully and only using the service for necessary expenses is important.

Also, avoid late payments, which can negatively impact your credit score. You can avoid negative consequences by setting reminders and tracking your payment schedule. If you’re struggling with the service or have questions or concerns, contact an Apple Pay Later Specialist for assistance or guidance.

More in shopping & credit

-

`

How To Travel the World Using Credits

Traveling can be an exhilarating and enriching experience, but it can also be expensive. However, with the right strategies and planning,...

December 3, 2023 -

`

Amazon’s $4 Billion Investment in Anthropic

In a move highlighting the intensifying battle in the tech industry, Amazon recently announced its substantial investment of up to $4...

November 24, 2023 -

`

Is the Future of Shopping Cashless?

The way we shop has significantly transformed in recent years, thanks to the rise of cashless payments. Traditional methods of exchanging...

November 18, 2023 -

`

Jeff Bezos and Lauren Sánchez’s $500 Million Superyacht

Set your course for a journey into the world of maritime magnificence as we unveil the $500 million superyacht belonging to...

November 11, 2023 -

`

Unlocking True Sustainability in Business and Finance

In the race towards a greener future, businesses and financial institutions have been progressing at a snail’s pace despite their public...

November 5, 2023 -

`

The Business of FaZe Clan

In the ever-evolving landscape of professional gaming and esports, few names have left as indelible a mark as FaZe Clan. Established...

October 26, 2023 -

`

7 Benefits of Shopping Sustainably

In a world that’s becoming increasingly aware of the environmental crisis, sustainable shopping has emerged as a powerful tool for individuals...

October 17, 2023 -

`

How the U.K. Became the Supercar Capital of the World

Picture the narrow streets of Milan with the roar of a Lamborghini passing by or the Autobahn with a Porsche zipping...

October 13, 2023 -

`

Fidelity’s Guide to Retirement: How to Join the Millionaire Club

Picture this: You are lounging on a yacht, the sun’s warm rays are making the turquoise waters shimmer. And the best...

October 6, 2023

You must be logged in to post a comment Login